Blogs

The Top 5 Mortgage Mistakes to Avoid

Buying your first home can be both exciting and nerve-wracking at the same time. With so many things to consider and....

Mortgage Do and Do not list

Mortgages can be tricky, and it's easy to make mistakes that can end up costing you dearly. That's why we've put together this list....

Tips On How To Improve Your Credit Score

Let's talk about some ways you can improve your credit score! Your credit score is actually a big deal, and it can affect...

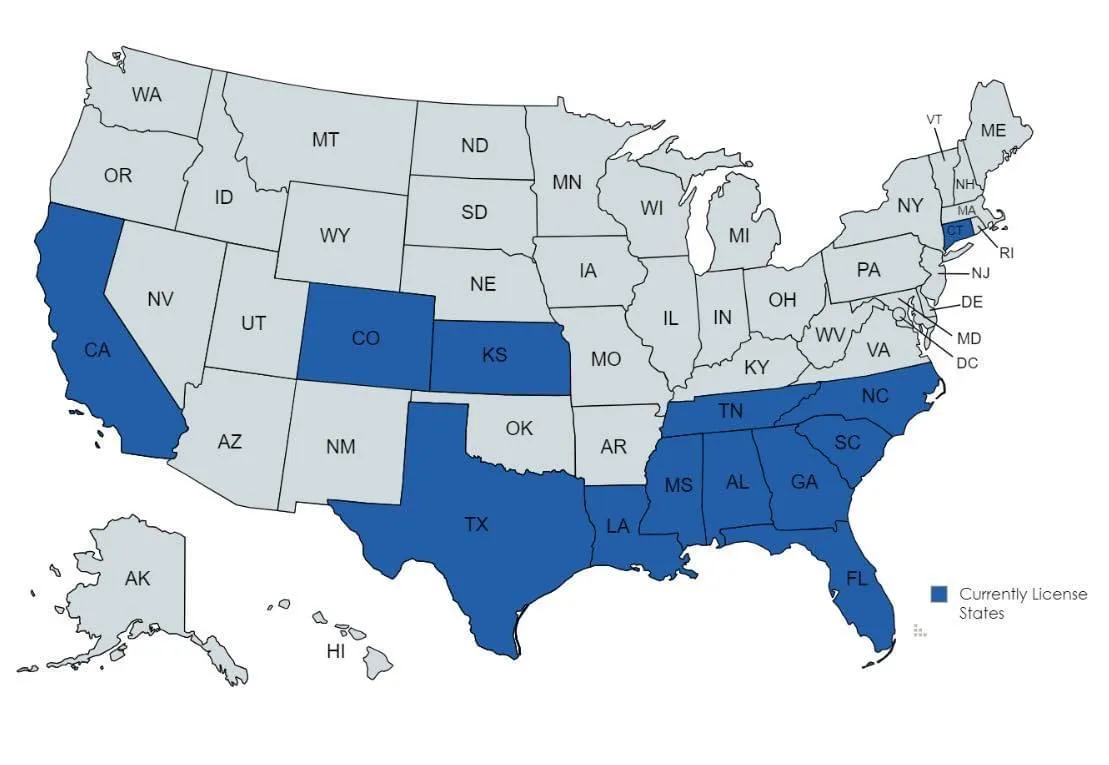

Our Service Areas

Our Service Areas and How We Help Local Clients with Great Rates and Programs

At Reliant Mortgage of Acadiana, we are proud to serve clients across a diverse range of locations, providing personalized mortgage solutions tailored to meet your unique needs. Whether you are buying your first home, refinancing an existing loan, or exploring your mortgage options, our dedicated team is here to help you every step of the way. Here is an overview of the major areas we cover and how we assist our clients with competitive rates and outstanding mortgage programs.

Alabama

We service major cities in Alabama including Birmingham, Montgomery, Mobile, Huntsville, and Tuscaloosa. Our team offers a variety of mortgage products designed to meet the needs of both first-time homebuyers and seasoned homeowners. We provide guidance on FHA loans, VA loans, and conventional loans, ensuring you get the best rates and terms available.

California

In California, we cover Los Angeles, San Francisco, San Diego, Sacramento, and San Jose. Given the state's diverse real estate market, we specialize in providing customized mortgage solutions that include jumbo loans, FHA loans, and refinance options. Our goal is to help you secure financing that aligns with your financial goals.

Colorado

For our clients in Colorado, including Denver, Colorado Springs, Aurora, Fort Collins, and Boulder, we offer competitive mortgage rates and a variety of loan programs. Whether you’re looking to buy in the bustling city of Denver or the scenic town of Boulder, we have the expertise to guide you through the mortgage process.

Connecticut

We service Hartford, New Haven, Stamford, Bridgeport, and Waterbury in Connecticut. Our team is well-versed in local real estate trends and works diligently to provide you with mortgage solutions that fit your budget and lifestyle. From first-time homebuyer programs to refinancing options, we are here to help.

Florida

In Florida, we cover Miami, Orlando, Tampa, Jacksonville, and Fort Lauderdale. We offer a range of mortgage products tailored to the unique needs of Florida homeowners, including FHA loans, VA loans, and refinancing programs. Our experienced team is dedicated to helping you find the right mortgage solution.

Georgia

We proudly serve Atlanta, Savannah, Augusta, Columbus, and Macon in Georgia. Our mortgage experts provide comprehensive support throughout the loan process, from pre-qualification to closing. We offer competitive rates and a variety of loan programs to suit your financial needs.

Kansas

In Kansas, we cover Wichita, Overland Park, Kansas City, Topeka, and Olathe. We provide local expertise and a wide range of mortgage products, including conventional loans, FHA loans, and VA loans. Our team is committed to helping you find the best financing options available.

Louisiana

We service New Orleans, Baton Rouge, Shreveport, Lafayette, and Lake Charles in Louisiana. As a local lender, we understand the unique aspects of the Louisiana real estate market and offer tailored mortgage solutions to meet your needs. Whether you're buying your first home or refinancing, we have the expertise to assist you.

Mississippi

Our services in Mississippi extend to Jackson, Gulfport, Biloxi, Hattiesburg, and Southaven. We offer competitive mortgage rates and a variety of loan programs designed to fit your financial situation. Our team is dedicated to helping you achieve your homeownership dreams.

North Carolina

We cover Charlotte, Raleigh, Greensboro, Durham, and Winston-Salem in North Carolina. Our team provides personalized mortgage solutions, including FHA loans, VA loans, and refinancing options. We strive to offer competitive rates and exceptional service to help you secure the financing you need.

South Carolina

In South Carolina, we service Charleston, Columbia, Greenville, Myrtle Beach, and Spartanburg. Our mortgage experts are here to guide you through the loan process, offering a range of products tailored to meet your needs. We are committed to providing great rates and excellent customer service.

Tennessee

We serve Nashville, Memphis, Knoxville, Chattanooga, and Clarksville in Tennessee. Our team offers a variety of mortgage programs, including conventional loans, FHA loans, and VA loans, designed to help you achieve your homeownership goals with competitive rates and terms.

Texas

In Texas, we cover Houston, Dallas, Austin, San Antonio, and Fort Worth. We provide local expertise and a comprehensive range of mortgage products to help you find the right financing solution. From first-time homebuyer programs to refinancing options, we are here to assist you.

How We Help Local Clients

At Reliant Mortgage of Acadiana, we understand that each client's financial situation is unique. That’s why we offer a personalized approach to mortgage lending, ensuring that you receive the best possible rates and terms. Our services include:

- Competitive Rates: We work diligently to provide our clients with the most competitive mortgage rates available in the market.

- Diverse Loan Programs: We offer a wide range of mortgage products, including FHA loans, VA loans, conventional loans, and refinancing options, to meet the diverse needs of our clients.

- Expert Guidance: Our experienced mortgage professionals are here to guide you through every step of the loan process, from pre-qualification to closing.

- Local Expertise: With a deep understanding of the local real estate markets, we provide tailored solutions that fit your specific needs and goals.

If you are looking to buy or refinance a home in any of these areas, enter your info below and we will get started with your home loan qualification. Our team is dedicated to helping you find the best mortgage solution to fit your needs, making the home buying or refinancing process smooth and stress-free. Let us assist you in achieving your homeownership dreams with personalized service and expert guidance.

For more information and to get started, visit our Application Portal.

Explore these vibrant cities and discover how Reliant Mortgage of Acadiana can assist you in achieving your homeownership goals.

10 Tips for First-Time Homebuyers

Buying your first home can be both exciting and nerve-wracking at the same time. With so many things to consider and....

How To Choose the Right Lender for You

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy

Refinancing youe loan and when to do it

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy

© Copyright 2024 McBride Mortgage Services @ Reliant Mortgage. All rights reserved

.McBride Mortgage Services @ Reliant Mortgage

. - NMLS: 1075152 | 4114 Toulouse St. New Orleans, LA 70119

.

Notice To Texas Loan Applicants: Consumers wishing to file a complaint against a mortgage banker, or a licensed mortgage banker residential mortgage loan originator, should complete and send a complaint form to the Texas Department of Savings and Mortgage Lending, 2601 North Lamar, Suite 201, Austin, TX 78705. Complaint forms and instructions may be obtained from the department’s website at www.sml.texas.gov

.

A toll-free consumer hotline is available at 1-877-276-5550. The department maintains a recovery fund to make payments of certain actual out of pocket damages sustained by borrowers caused by acts of licensed mortgage banker residential mortgage loan originators. A written application for reimbursement from the recovery fund must be filed with and investigated by the department prior to the payment of a claim. For more information about the recovery fund, please consult the department’s website at www.sml.texas.gov